Introduction to Stock Charts

Reading stock charts, or technical analysis, is an essential skill for any investor or trader. It’s the study of past and present market data primarily price and volume, and it can help forecast future market behavior. It might seem complex at first, but don’t fret – we’re here to break it down for you.

Why Stock Charts are Important

Stock charts are a trader’s roadmap. They provide historical data about a stock’s performance, which can be used to predict future trends. It’s like the weather forecast of the financial market; it can’t predict the future with 100% certainty but gives you an idea of what to expect.

Types of Stock Charts

There are three main types of stock charts: line charts, bar charts, and candlestick charts. Line charts are the simplest, displaying only closing prices. Bar charts include opening, closing, high, and low prices. Candlestick charts, the most detailed, provide the same data as bar charts but in a more visual way.

Basic Elements of Stock Charts

Price

The price, typically displayed on the vertical axis, shows the stock’s price change over a period.

Volume

Volume, often shown as a bar chart beneath the price chart, represents the number of shares traded during a certain period. It provides insights into the strength of price movements.

Time Frames

The horizontal axis of a stock chart displays time. Traders use different time frames based on their trading style: day traders may use 1-minute charts, swing traders might use hourly or daily charts, and long-term investors often use weekly or monthly charts.

Types of Stock Chart Patterns

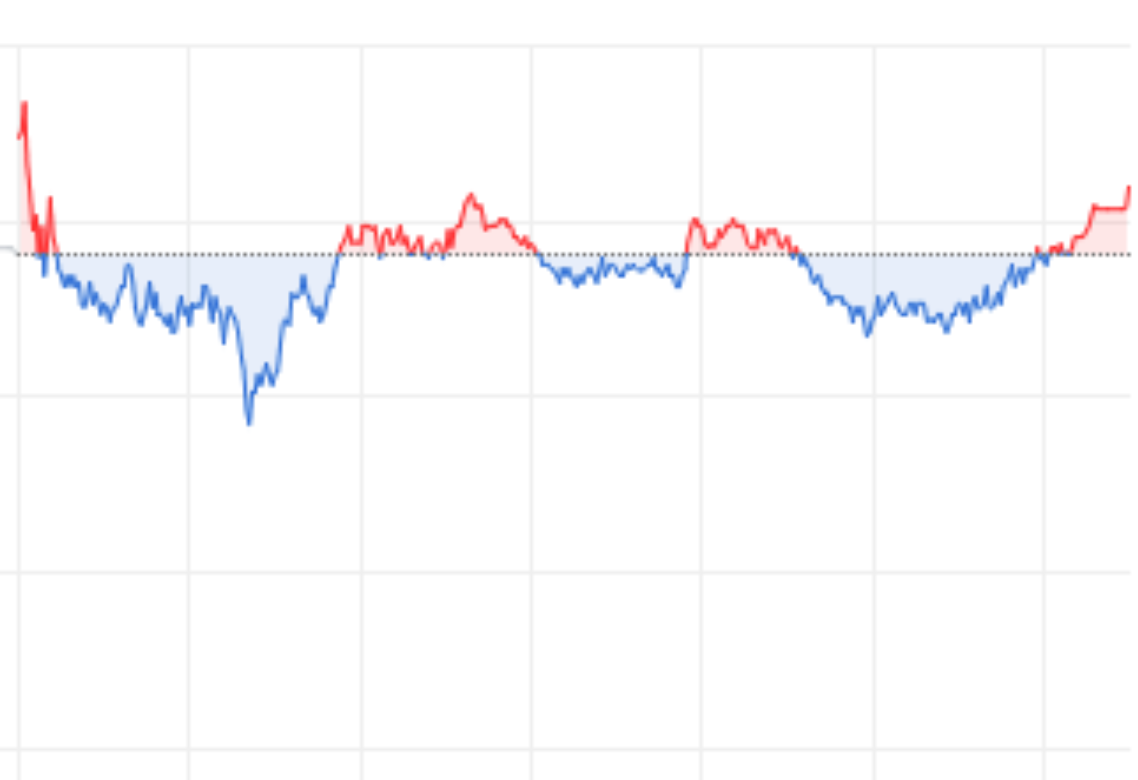

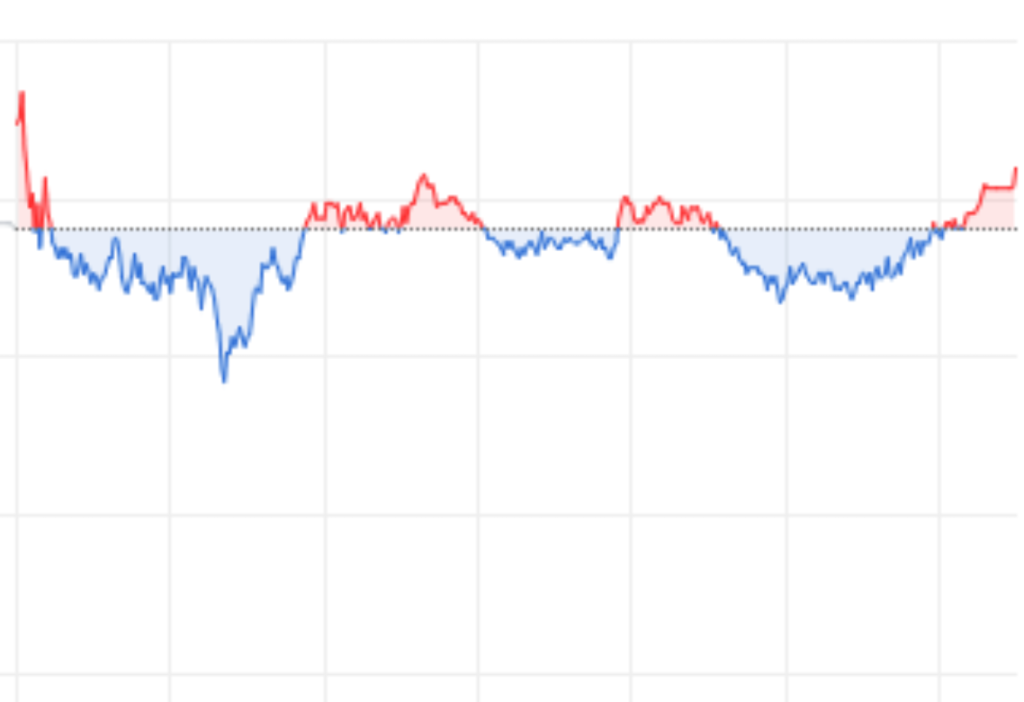

Bullish and Bearish Patterns

Chart patterns can hint at price movements. Bullish patterns indicate potential upward movements, while bearish patterns suggest possible downward trends.

Head and Shoulders

The head and shoulders pattern is typically a bearish reversal pattern, indicating that a stock’s price may fall after the formation is complete.

Double Top and Double Bottom

Double top patterns are bearish reversal patterns, suggesting a drop after the second peak. Double bottom patterns are the opposite – they’re bullish and signal a possible price rise following the second bottom.

Technical Indicators

Moving Averages

Moving averages smooth out price data to identify trends over specified periods. For example, a 200-day moving average shows the average closing price over the last 200 days.

Relative Strength Index (RSI)

The RSI is a momentum indicator measuring the speed and change of price movements. It ranges from 0 to 100 and is used to identify overbought (above 70) and oversold (below 30) conditions.

Strategies for Reading Stock Charts

Trend Following

Trend followers buy stocks during uptrends and sell during downtrends. They use technical analysis to identify these trends and make trading decisions.

Reversal Trading

Reversal traders aim to identify the peaks and troughs of a stock’s price to profit from trend reversals.

Conclusion

Reading stock charts is essential for effective trading and investing. While it doesn’t guarantee success, understanding how to analyze stock charts can significantly improve your decision-making process. The key is to combine this knowledge with sound risk management strategies.